With 2020 behind us, Martins Sulte, CEO of Mintos, explains what 2021 might hold for the FinTech or FinTech sector.

2020 has been a tumultuous year in many ways. Due to the uncertainty generated by the Covid-19 pandemic, dictating the way forward, the business world has been profoundly disrupted, raising many fundamental questions and leaving even more unanswered. And yet, it seems that FinTech has managed to stay afloat and even grow. A recent study estimated that, despite the pandemic, twelve of the thirteen FinTech sectors recorded year-over-year growth in the first half of 2020 compared to the same period in 2019. Martins Sulte, CEO and Co-Founder of Mintos, shared his views on the most important challenges and opportunities facing FinTech in 2021.

Opportunities

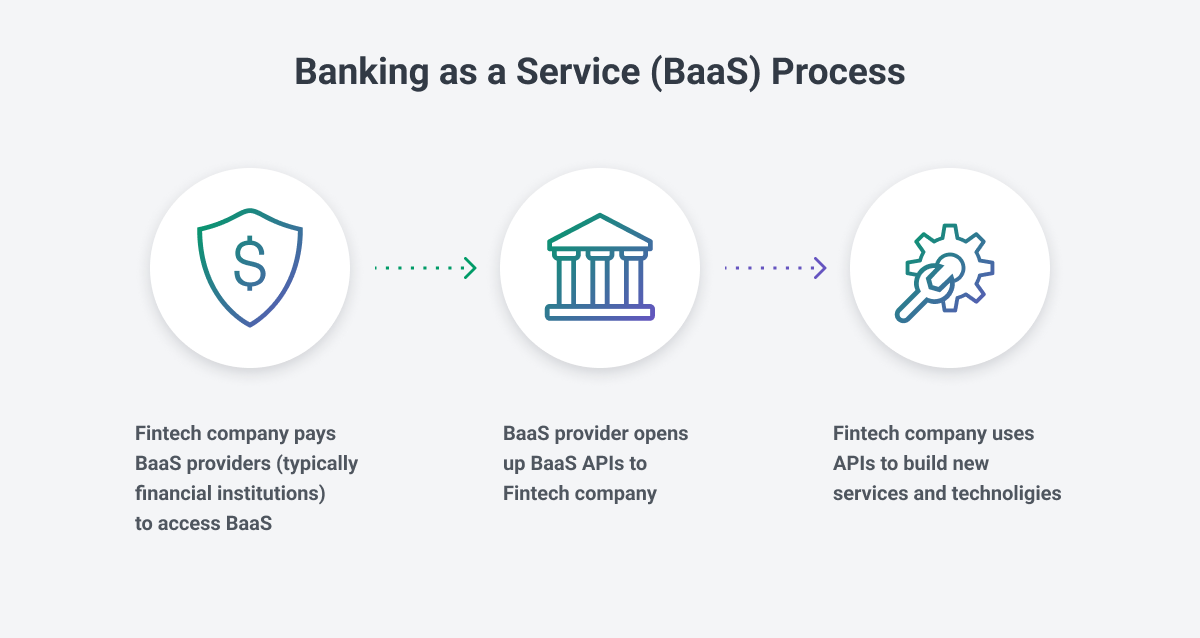

1. BaaS. Banking-as-a-service or BaaS provides banking processes to integrate financial services into any business. BaaS allows you to focus on product innovation rather than infrastructure development and thus creates an opportunity for any tech company to become a Fintech in no time. As an example you can consider Alif becoming one of the leading fintech companies

“Already in 2020 we have seen an explosion of BaaS phenomena and the immense related opportunities open” says Martins Sulte. “So it makes sense to expect that in 2021, more and more BaaS companies will emerge as they could help tech companies gain an edge over their competition. Martins Sulte also said that further exploration of BaaS will only accelerate open banking, which in turn will help the growth of BaaS companies around the world. Overall, BaaS will continue to push banking services to the digital world, especially apps.

2. Biometrics. The possibility of online fraud is steadily increasing with the expansion of the FinTech industry. Concerns about cybercrime are also voiced by consumers themselves, with 56% preferring to use a biometric sensor for authentication rather than a PIN code.

“It is not only the FinTech sector that is growing, but the sheer number of bad actors and their fraud methods are also increasing,” says Martins Sulte. “Biometrics offer an effective way to largely, if not completely, eliminate the risk of fraud. Given the incredible variety of solutions available, from 3D facial recognition to video self-identification, it’s no surprise that many see biometrics as the future of identification. Biometric identity verification is already gaining momentum, with projected growth from $ 7.6 billion in 2020 to $ 15.8 billion in 2025. Martins Sulte believes 2021 could be the year of the rapid expansion of biometric-based authentication systems to enhance security and curb fraud.

3. Subscription. Subscription services are booming across all industries, which was particularly evident during the pandemic. If some fintechs have already introduced. subscription services, others could adopt similar measures in 2021 to stimulate growth.

“Membership is a great way to offer more and better services or products for a small fee, and we see that it works,” adds Martins Sulte. “As the subscription fintech pioneers begin to roll out subscription-based services, more companies should try to take advantage of them. “